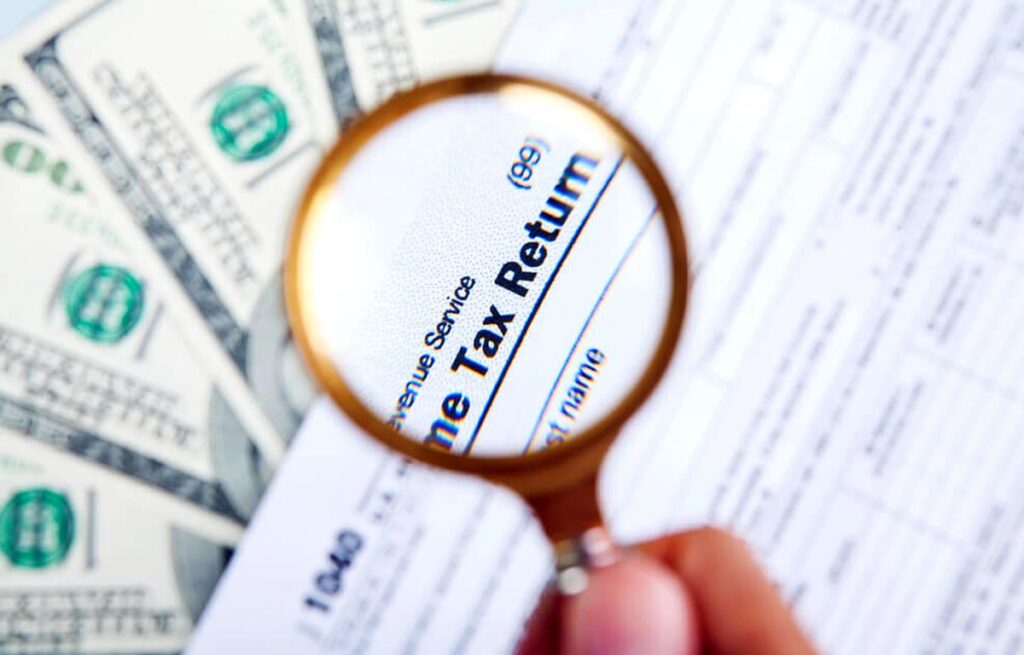

Tax Return Analysis: Understanding the Basics and Maximizing Returns

Welcome to the ultimate guide on tax return analysis. Understanding your tax returns can be a daunting task, but fear not, as we delve into the intricacies of this process. Whether you’re a seasoned taxpayer or just starting, this guide will equip you with the knowledge needed to decipher your tax returns with confidence.

What is Tax Return Analysis?

Tax return analysis involves the examination of financial data presented in tax returns filed by individuals or entities. It encompasses a thorough review of income, deductions, credits, and other relevant financial information reported to tax authorities.

Importance of Tax Return Analysis

Tax return analysis provides valuable insights into an individual’s or entity’s financial standing, tax liabilities, and overall financial management practices. It aids in identifying areas for potential tax savings, detecting errors or discrepancies, and assessing compliance with tax laws and regulations.

Understanding Key Components of Tax Returns

To conduct a comprehensive tax return analysis, it is essential to understand the key components of tax returns. These components include:

1. Income

Income reported on tax returns encompasses various sources, such as wages, salaries, investments, rental income, and business income. Analyzing income streams helps evaluate overall financial stability and assess income tax liabilities.

2. Deductions and Credits

Deductions and credits play a crucial role in reducing taxable income and optimizing tax returns. Common deductions include mortgage interest, charitable contributions, and medical expenses, while credits, such as the Earned Income Tax Credit (EITC) or Child Tax Credit, directly reduce tax liability.

3. Expenses

Businesses and self-employed individuals often incur various expenses related to operations, marketing, supplies, and equipment. Analyzing these expenses provides insights into business profitability and potential areas for cost-saving measures.

4. Taxable Income and Tax Liability

Taxable income is the amount of income subject to taxation after deductions and credits have been applied. Calculating taxable income helps determine the final tax liability, which is the amount of tax owed to the government.

Methods of Tax Return Analysis

Several methods and techniques are employed to analyze tax returns effectively. These include:

1. Comparative Analysis

Comparative analysis involves comparing current tax returns with previous years’ returns to identify trends, changes in income or expenses, and potential anomalies.

2. Ratio Analysis

Ratio analysis utilizes financial ratios derived from tax return data to assess financial performance, liquidity, profitability, and solvency. Common ratios include the debt-to-equity ratio, profit margin, and return on investment (ROI).

3. Trend Analysis

Trend analysis examines financial data over multiple periods to identify patterns, fluctuations, and growth trajectories. It helps assess financial stability, identify areas of improvement, and forecast future performance.

4. Benchmarking

Benchmarking involves comparing tax return data with industry standards or peer group averages to evaluate performance, identify best practices, and set performance targets.

Maximizing Tax Returns Through Analysis

Effective tax return analysis can lead to various strategies for maximizing tax returns and optimizing financial outcomes. These strategies include:

1. Leveraging Deductions and Credits

Identifying and maximizing available deductions and credits can significantly reduce tax liabilities and increase tax refunds. Taxpayers should explore all eligible deductions and credits to minimize tax burdens effectively.

2. Strategic Timing of Income and Expenses

Timing income and expenses can impact taxable income in a given tax year. Strategies such as deferring income or accelerating deductible expenses can optimize tax outcomes and maximize returns.

3. Tax Planning and Forecasting

Proactive tax planning involves anticipating future tax implications and implementing strategies to minimize tax liabilities. By forecasting income, expenses, and changes in tax laws, individuals and businesses can make informed decisions to optimize tax returns.

4. Consulting Tax Professionals

Seeking guidance from qualified tax professionals, such as certified public accountants (CPAs) or tax advisors, can provide valuable insights and expertise in tax planning, compliance, and optimization strategies.

Final Wording

Tax return analysis serves as a cornerstone of financial management and tax planning. By understanding the fundamentals of tax return analysis, individuals and businesses can optimize tax returns, minimize tax liabilities, and achieve financial goals effectively.

FAQs (Frequently Asked Questions)

What tools can help with tax return analysis?

Tax software programs, spreadsheets, and financial analysis tools Like Cash Flow Assistance can assist in organizing, analyzing, and interpreting tax return data.

How often should tax return analysis be performed?

Tax return analysis should ideally be conducted annually, coinciding with the preparation and filing of tax returns.

Is tax return analysis only relevant for individuals?

No, tax return analysis is relevant for individuals, businesses, nonprofit organizations, and other entities required to file tax returns.

Can tax return analysis help in tax planning for future years?

Yes, tax return analysis provides insights into past financial performance and can inform tax planning strategies for future years.

What are the potential risks of not conducting tax return analysis?

Without tax return analysis, individuals and businesses may overlook opportunities for tax savings, incur unnecessary tax liabilities, and face compliance issues with tax authorities.