Private equity investments involve significant capital commitments and long-term financial commitments, making accurate cash flow forecasting essential for investors and fund managers. By projecting cash inflows and outflows over the investment lifecycle, stakeholders can make informed decisions, mitigate risks, and maximize returns on their investments. In this guide, we delve into the intricacies of private equity cash flow forecasting, offering insights, strategies, and best practices to optimize financial planning and drive investment success.

Understanding Private Equity Cash Flow Forecasting

What is Private Equity Cash Flow Forecasting?

Private equity cash flow forecasting involves estimating the future cash inflows and outflows associated with private equity investments, including capital contributions, distributions, fees, and expenses. It enables investors and fund managers to anticipate cash needs, assess investment performance, and make strategic decisions to optimize returns and manage liquidity.

Importance of Cash Flow Forecasting in Private Equity

Discuss the significance of cash flow forecasting in private equity investments, where capital deployment and liquidity management are critical for achieving investment objectives and meeting investor expectations. Highlight the role of cash flow projections in assessing investment viability, monitoring performance, and mitigating risks throughout the investment lifecycle.

Key Components of Private Equity Cash Flow Forecasting

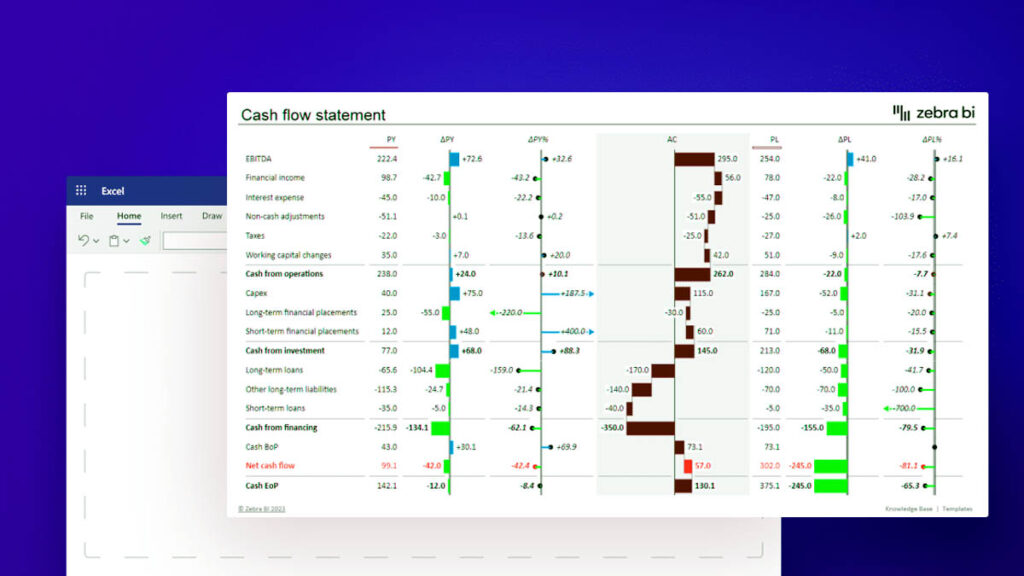

Outline the key components of private equity cash flow forecasting, including capital calls, distributions, management fees, carried interest, operating expenses, and taxes. Discuss how each component contributes to the overall cash flow dynamics of private equity investments and impacts investment returns and liquidity management.

Strategies for Effective Cash Flow Forecasting

Historical Data Analysis

Emphasize the importance of historical data analysis in private equity cash flow forecasting, leveraging past investment performance, fund structures, and market trends to inform future projections. Discuss the significance of data integrity, accuracy, and consistency in building reliable cash flow models and making informed investment decisions.

Scenario Analysis and Sensitivity Testing

Highlight the value of scenario analysis and sensitivity testing in assessing the impact of various market conditions, economic scenarios, and investment outcomes on cash flow projections. Encourage investors and fund managers to evaluate multiple scenarios, stress test assumptions, and prepare contingency plans to manage risks effectively.

Portfolio Diversification and Risk Management

Discuss the role of portfolio diversification and risk management strategies in mitigating cash flow volatility and enhancing investment resilience in private equity portfolios. Explore techniques such as asset allocation, sector diversification, and investment structuring to optimize risk-adjusted returns and minimize downside risks.

Implementing Best Practices

Robust Cash Flow Modeling

Recommend adopting robust cash flow modeling techniques and software tools to streamline the private equity cash flow forecasting process and enhance accuracy and efficiency. Highlight the benefits of using specialized financial modeling platforms, Excel templates, and data analytics tools to develop dynamic and customizable cash flow models.

Stakeholder Communication and Transparency

Stress the importance of transparent communication and collaboration with investors, limited partners, and other stakeholders throughout the cash flow forecasting process. Encourage fund managers to provide regular updates, detailed reports, and clear explanations of cash flow projections, assumptions, and performance metrics to build trust and foster investor confidence.

Continuous Monitoring and Adjustment

Advocate for continuous monitoring and adjustment of cash flow forecasts based on changing market conditions, investment performance, and regulatory developments. Emphasize the need for agility and responsiveness in updating assumptions, revising projections, and adapting investment strategies to optimize cash flow management and achieve investment objectives.

Private Equity Cash Flow Forecasting FAQs

How often should private equity firms update their cash flow forecasts?

Private equity firms should update their cash flow forecasts regularly, typically on a quarterly or semi-annual basis, to reflect changes in market conditions, investment performance, and fund dynamics. However, more frequent updates may be necessary during periods of heightened volatility or significant events impacting the investment portfolio.

What factors should be considered in private equity cash flow forecasting?

Key factors to consider in private equity cash flow forecasting include investment valuations, fund commitments, capital deployment schedules, distribution timelines, management fees, carried interest calculations, tax implications, and regulatory compliance requirements. Each factor plays a critical role in shaping cash flow projections and investment outcomes.

How do private equity firms manage liquidity risk in cash flow forecasting?

Private equity firms manage liquidity risk in cash flow forecasting by maintaining sufficient cash reserves, implementing conservative leverage ratios, diversifying investment portfolios, and proactively monitoring liquidity metrics such as cash coverage ratios and liquidity buffers. Additionally, firms may use financial instruments such as lines of credit or bridge financing to address short-term liquidity needs.

Can private equity cash flow forecasting help investors assess investment performance?

Yes, private equity cash flow forecasting provides investors with valuable insights into investment performance, including realized and unrealized returns, cash-on-cash multiples, internal rates of return (IRR), and net asset value (NAV) growth. By comparing actual cash flow outcomes against forecasted projections, investors can evaluate investment performance and make data-driven decisions.

How can private equity firms optimize cash flow forecasting accuracy?

Private equity firms can optimize cash flow forecasting accuracy by improving data quality and granularity, refining modeling methodologies and assumptions, incorporating feedback from industry experts and advisors, and leveraging advanced analytics and predictive modeling techniques. Additionally, firms should conduct regular reviews and validations of cash flow models to identify and address potential errors or discrepancies.

Are there specialized software tools for private equity cash flow forecasting?

Yes, several specialized software tools and platforms are available for private equity cash flow forecasting, offering features such as scenario analysis, sensitivity testing, portfolio management, and reporting capabilities. Examples include private equity-specific financial modeling software, fund administration platforms, and portfolio management systems tailored to the needs of private equity investors and fund managers.

Final Wording

Private equity cash flow forecasting is a critical component of financial planning and decision-making in the dynamic and competitive landscape of private equity investments. By implementing effective strategies, leveraging best practices, and adopting robust cash flow modeling techniques, investors and fund managers can enhance cash flow management, mitigate risks, and optimize investment returns. Remember, proactive and data-driven cash flow forecasting is essential for achieving long-term success and delivering value to stakeholders in private equity investments.